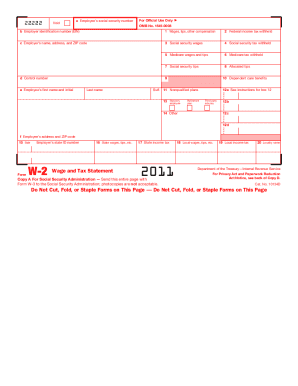

Get the free modot pay stub form

Show details

Moot & MHP Electronic Pay Stub Step-by-Step Instructions Log on to the secure Internet site: https://medlife.modot.mo.gov or click on the Employee Self Serve” icon Employee Self Serve BS s on your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your modot pay stub form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your modot pay stub form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit modot pay stub online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit medlife modot form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out modot pay stub form

How to fill out modot pay stub:

01

Obtain a copy of the modot pay stub form. You can either download it from the modot website or obtain a hard copy from your employer.

02

Begin by filling out your personal information accurately. This typically includes your full name, address, social security number, and employment identification number.

03

Next, fill out the pay period for which the pay stub is being generated. This can usually be found on your employer's payroll schedule or by checking with your supervisor.

04

Enter your earnings for the specific pay period. This includes your regular wages, overtime pay, bonuses, and any other additional income earned during the period.

05

Deduct any pre-tax deductions from your earnings, such as contributions to a retirement plan or health insurance premiums. These deductions are typically listed as separate line items on the pay stub.

06

Subtract any applicable taxes, such as federal, state, and local income taxes, along with Social Security and Medicare taxes. These deductions are mandatory and are often calculated based on your income and tax withholding status.

07

If you have any post-tax deductions, such as voluntary contributions to a charity or loan repayments, subtract them from your earnings.

08

Calculate your net pay by subtracting all deductions from your earnings. This is the amount of money you will receive after taxes and deductions have been taken out.

09

Finally, review the completed pay stub for accuracy. Make sure all the numbers and information entered are correct. If you notice any discrepancies, notify your employer immediately to rectify the issue.

Who needs modot pay stub:

01

Employees of the Missouri Department of Transportation (MoDOT) who are paid by the department.

02

Contractors and vendors who perform services for MoDOT and need to provide proof of income or payment records.

03

Individuals who require documentation of their earnings for tax purposes or other legal requirements.

Fill medlife mo gov : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is modot pay stub?

Modot Pay Stub is an online payroll portal used by employees of the Missouri Department of Transportation (MoDOT). This portal allows employees to view and print their pay stubs, access payroll information, and manage direct deposit information.

What information must be reported on modot pay stub?

A Missouri Department of Transportation (MoDOT) pay stub must include the employee's name, job title, pay period, leave balances, gross wages, deductions, net wages, and in-state and out-of-state travel reimbursements. Additionally, the pay stub must include the employer's name and address, the employee's Social Security number, and the state and federal income tax withholding information.

What is the penalty for the late filing of modot pay stub?

I'm not able to provide you with the specific penalty for the late filing of a modot pay stub as it may vary depending on the specific rules and regulations of the Missouri Department of Transportation (MoDOT). It is best to consult MoDOT's official website or contact their office directly to get accurate and up-to-date information on any penalties associated with late filing.

How to fill out modot pay stub?

To fill out a Modot pay stub, follow these steps:

1. Start by entering your personal information at the top of the pay stub. This typically includes your full name, employee ID or social security number, and contact information.

2. Enter the pay period start and end dates. These dates will determine the time period for which you are being paid.

3. Next, enter your pay rate or salary. This is the amount you earn per hour or the agreed-upon salary for the pay period.

4. Calculate your total hours worked during the pay period. If you are a salaried employee, this may not be necessary.

5. Compute your gross pay, which is the total amount you earned before any deductions are taken out. Multiply your total hours worked by your pay rate to calculate this amount.

6. Deduct any pre-tax deductions from your gross pay. This may include items like health insurance premiums, retirement contributions, or flexible spending account contributions. Subtract these deductions from your gross pay to determine your taxable income.

7. Subtract any required taxes from your taxable income, such as federal income tax, state income tax, or Social Security and Medicare taxes (FICA). These deductions are typically calculated based on a percentage of your taxable income.

8. Subtract any post-tax deductions from your taxable income. This could include items like union dues, voluntary retirement contributions, or charitable donations. These deductions are typically subtracted after taxes are calculated.

9. After deduction calculations, you should reach your net pay or take-home pay. This is the amount you will receive on your paycheck.

10. Finally, if there are any additional sections on the Modot pay stub, such as vacation or sick leave balances, make sure to fill them out as required.

Remember to always double-check your calculations and ensure that all information is accurate before submitting your pay stub.

Can I create an electronic signature for the modot pay stub in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your medlife modot form in seconds.

How do I edit peoplesoft modot mo gov straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing modot paystub.

How do I fill out oracle modot pay stub on an Android device?

Use the pdfFiller Android app to finish your modot medlife form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your modot pay stub form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Peoplesoft Modot Mo Gov is not the form you're looking for?Search for another form here.

Keywords relevant to modot oracle form

Related to medlife modot mo gov

If you believe that this page should be taken down, please follow our DMCA take down process

here

.